India's current account deficit to widen in FY23, says brokerage Edelweiss

ANI

24 Jun 2022, 11:07 GMT+10

New Delhi [India], June 24 (ANI): India's current account deficit (CAD) is expected to widen and be in the range of 2.6 per cent to 2.8 per cent of gross domestic product (GDP) in the current financial year FY23, said brokerage and financial services firm Edelweiss Broking.

The high merchandise trade deficit coupled with the fund outflow from financial markets has weakened India's external account or balance of payment position.

Notably, foreign portfolio investors have been pulling out money from India for the past consecutive eighth-to-nine months.

"The country's balance of payment slipped into a deficit of $16 billion in Q4 FY22 for the first time in 13 quarters after recording a marginal surplus of $0.47 billion in Q3 FY22. For the financial year, although the BoP recorded a surplus of $47.5 billion, it was lower by $40 billion or 46 per cent than that in FY21 and the lowest in three years," the brokerage said.

This has implications for the Indian currency rupee, and the weakness in the rupee is to prevail, it said adding that it expects the rupee movement in the range of 77.5 to 79 over the next 2-3 months.

The lower foreign currency receipts compared with payments/outflows have been weighing down the Indian rupee which has depreciated by over 5 per cent since the start of 2022.

For FY22, the current account deficit came in at $38 billion or 1.2 per cent of GDP as against a surplus of $24 billion or 0.9 per cent of GDP in FY21, which was the highest in three years.

The widening of the current account deficit in FY22 was primarily due to the surge in the merchandise trade deficit which nearly doubled from that in the previous year to worth $189 billion owing to the higher imports of goods associated with the revival in economic activity and rise in global commodity prices, it added.

In terms of financial flows in FY22, net total foreign investment inflows of around $22 billion were 73 per cent lower than FY21. This was mainly due to the net foreign portfolio investments outflow to the tune of $16.8 billion, which is in sharp contrast to the net inflows of $36 billion in FY21. (ANI) Share

Share

Tweet

Tweet

Share

Share

Flip

Flip

Email

Email

Watch latest videos

Subscribe and Follow

Get a daily dose of Nepal National news through our daily email, its complimentary and keeps you fully up to date with world and business news as well.

News RELEASES

Publish news of your business, community or sports group, personnel appointments, major event and more by submitting a news release to Nepal National.

More InformationBusiness

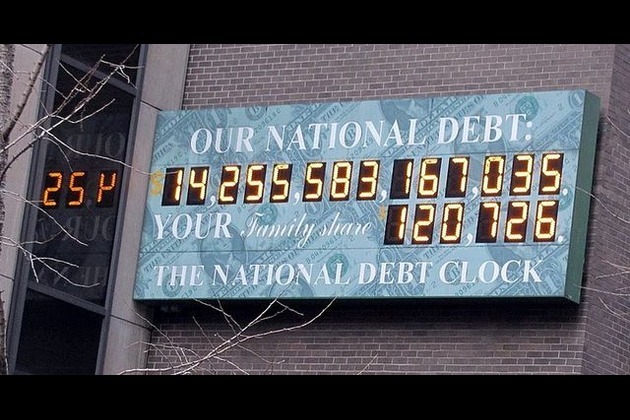

SectionUS debt limit raised, but spending bill fuels fiscal concerns

NEW YORK CITY, New York: With just weeks to spare before a potential government default, U.S. lawmakers passed a sweeping tax and spending...

Shein hit with 40 million euro fine in France over deceptive discounts

PARIS, France: Fast-fashion giant Shein has been fined 40 million euros by France's antitrust authority over deceptive discount practices...

Meta hires SSI CEO Gross as AI race intensifies among tech giants

PALO ALTO/TEL AVIV: The battle for top AI talent has claimed another high-profile casualty—this time at Safe Superintelligence (SSI),...

Engine defect prompts Nissan to recall over 443,000 vehicles

FRANKLIN, Tennessee: Hundreds of thousands of Nissan and Infiniti vehicles are being recalled across the United States due to a potential...

Microsoft trims jobs to manage soaring AI infrastructure costs

REDMOND, Washington: Microsoft is the latest tech giant to announce significant job cuts, as the financial strain of building next-generation...

Stocks worldwide struggle to make ground Friday with Wall Street closed

LONDON UK - U.S. stock markets were closed on Friday for Independence Day. Global Forex Markets Wrap Up Friday with Greeback Comeback...

Southeast Asia

SectionTrump signals progress on India Trade, criticizes Japan stance

WASHINGTON, D.C.: President Donald Trump says the United States could soon reach a trade deal with India. He believes this deal would...

UN Demands End to Myanmar Violence as Junta’s Election Plans Risk Further Instability

Nearly three months after a devastating earthquake struck Myanmar, the country remains trapped in a deepening crisis, compounded by...

BRICS outperforming G7 Putin

The groups combined GDP is $20 trillion greater than that of the Western bloc, the Russian president has said BRICS has already outstripped...

Modi calls on BRICS nations to condemn terrorism

The summit declaration denounced the recent terrorist attack in Kashmir that triggered a military escalation between India and Pakistan...

"Bravehearts of Indian Armed Forces damaged, destroyed and dismantled "territory of terrorism": Mukhtar Abbas Naqvi

Prayagraj (Uttar Pradesh) [India], July 6 (ANI): Former Union Cabinet Minister and senior BJP leader Mukhtar Abbas Naqvi on Sunday...

Condemning terrorism should be our 'principle', not just 'convenience': PM Modi at BRICS summit

Rio de Janeiro [Brazil], July 6 (ANI): Prime Minister Narendra Modi, during the 17th BRICS Summit on Sunday, asserted that condemning...